Salazar & Associates, CPAs

Certified Public Accountants

Our office closes at 1 PM

on April 15th.

Important Updates

Individual Tax Returns (IRS Form 1040)

Filing Deadline for 2023 taxes is April 15, 2024.

If you can’t file by the due date of your return, you should request an extension of time to file. To receive an automatic 6-month extension of time to file your return, you must file Form 4868, Application for Automatic Extension of Time to File. An extension of time to file is not an extension of time to pay. You may be subject to a late payment penalty on any tax not paid by the original due date of your return.

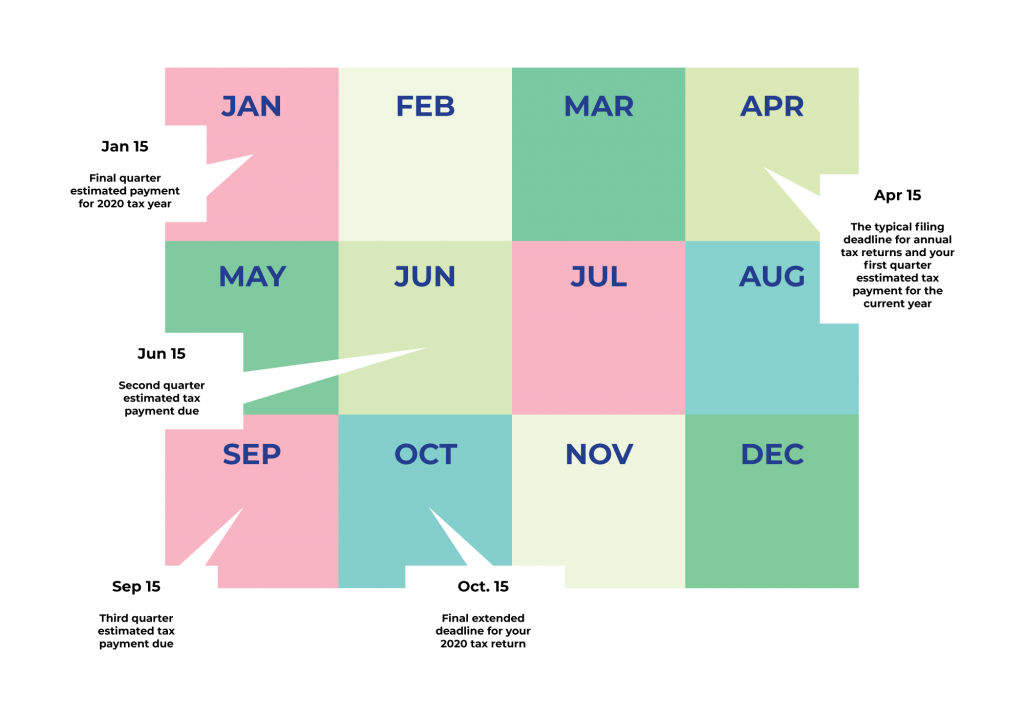

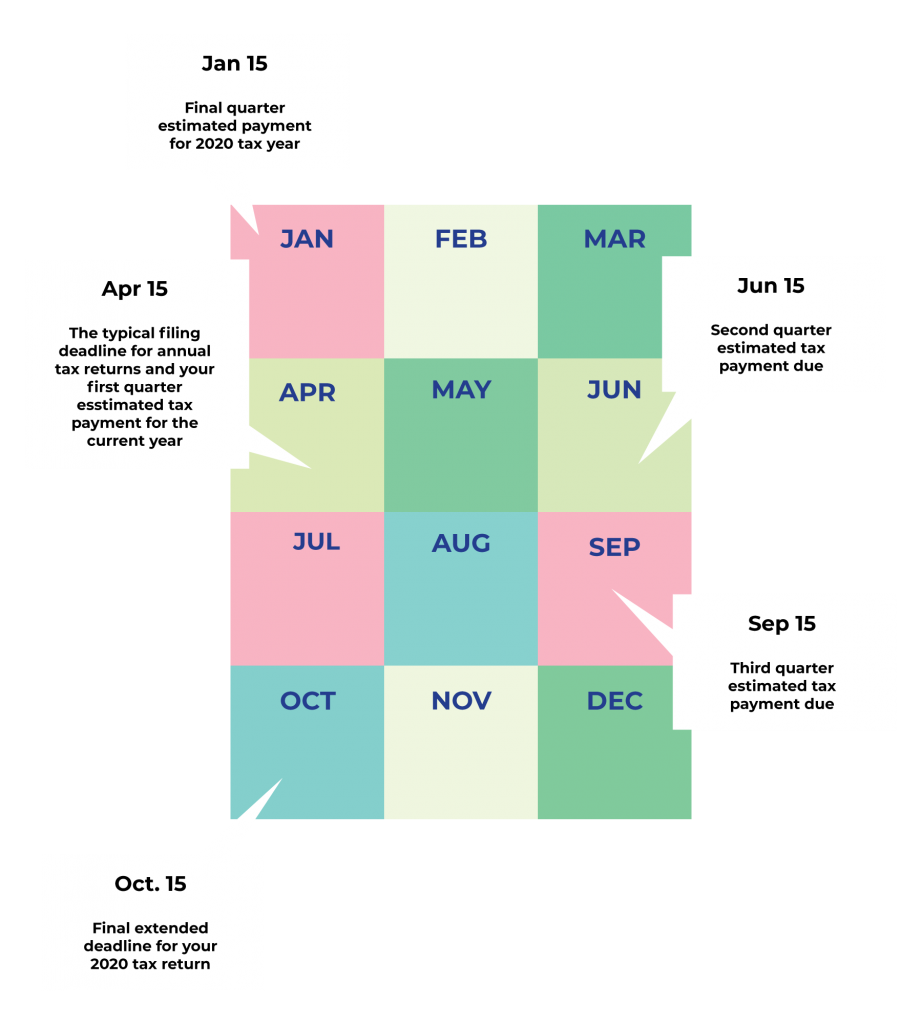

Important Tax Deadlines in 2021

Partnership returns (IRS Form 1065): These are due March 15, 2024, for partnerships operating on a calendar year. The extended deadline is September 16, 2024.

S-corporation returns (IRS Form 1120-S): These returns are due March 15, 2024, for corporations operating on a calendar year. The extended deadline is September 16, 2024.

C-corporation income tax returns (IRS Form 1120): These are due April 15, 2024, for C-corporations operating on a calendar year. The extended deadline is October 15, 2024.

Important Links

Where’s My Refund?

Taxpayers who have filed a return and are waiting for their refund can use Where’s My Refund? to check the status of a refund payment. This tool is available at IRS.gov or through the IRS2Go app. Updates are available within 24 hours after the IRS receives an e-filed return or four weeks after the agency receives a mailed paper return.

View federal tax account information online.

Individuals can visit IRS.gov to set up their account. If they already have a username and password, they can log in to view their federal tax account balance, payment history and key information from their most recent tax return as originally filed. Before accessing their account for the first time, taxpayers must authenticate their identity through the secure access process.

Pay a tax bill.

The IRS offers several ways for taxpayers to pay their taxes including online, by phone or through the IRS2Go app. Direct Pay is free and a safe way to pay taxes or estimated tax directly from a checking or savings account. Direct Pay has five simple steps to pay in a single online session and is also available with the IRS2Go mobile app.

GET IN TOUCH WITH US!

Email: salazarcpas@gmail.com

Phone: 512.440.7184

All Rights Reserved.